portability real estate taxes florida

A change in ownership may reset the assessed value of the property to full market value which could result in higher property taxes. Market Value Assessed Value New Property moving or moved.

What Is Florida Homestead Portability Epgd Business Law

Florida Homestead Real Estate Tax Portability Explained January 18 2021 For those who have made a home in Florida and are considering a move to a new Florida home one of the most important things to be aware of is the newly enacted Property Tax Portability Amendment which impacts Homestead property.

. Through the introduction of Amendment 1 on January 29 2008 Florida voters amended the State constitution to provide for transfer of a Homestead Assessment Difference from one property to another. Market and assessed values can be found on any Florida Countys Notice of Proposed Property Taxes. Portabilitys purpose is basically twofold.

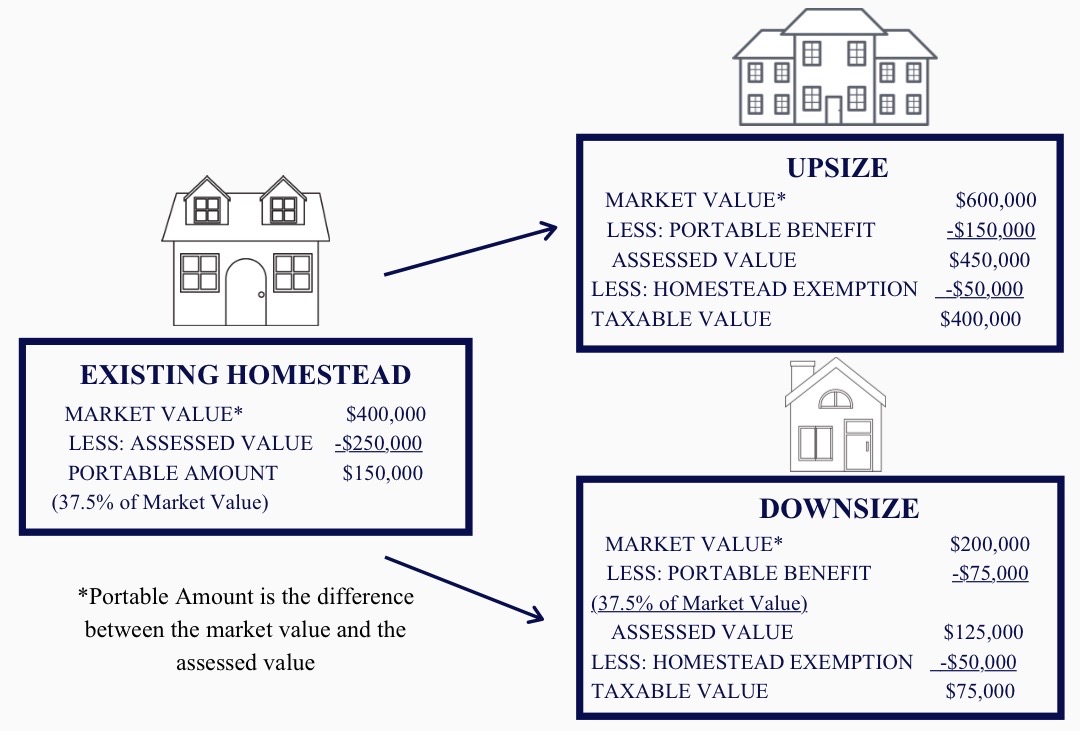

It may be transferred to any property in Florida and is commonly referred to as PORTABILITY. 94 dollars of tax dollars are received by Boca Raton from the City. Floridas Save Our Homes SOH provision allows you to transfer all or a significant portion of your tax benefit up to 500000 from a Florida home with a homestead exemption to a new home within the state of Florida that qualifies for a homestead exemption.

Portability benefits may be reduced if the benefit is split among multiple. If you are eligible portability allows most Florida homestead owners to transfer their SOH benefit from their old homestead to a new homestead lowering the tax assessment and consequently the taxes for the new homestead. A total of 7 million in federal tax dollars is part of this total.

Wow what a day for Property Tax Portability and property owners in Florida the great news is regardless of the results Pinellas County is reporting a 37 voter turnout which tops even the 2000 and 2004 Presidential Primaries. Buying A Home Homestead Property Taxes. Portability estimator Portability is the difference between the Property Appraisers Just Value of a property and the Save Our Homes value of that property.

Before buying real estate property. 350000 - 200000 150000 in Tax Benefit. 1 To not penalize Florida homeowners who leave their homestead residences by preserving the cap in moving to new homesteaded residences and.

The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home. In other words you may only go one tax year without having. To learn more about portability click the Frequently Asked Questions link here property tax portability Additional 25000 Homestead Exemption for a total of 50000 in homestead exemptions If you currently have a homestead exemption there is no action required on your part to obtain the additional 25000 homestead exemption.

Property Tax Portability Florida Election Results are In Real Estate a Big Winner. You sell your current Florida Homestead that has an Assessed Value of 200000 and a Just Market Value of 350000. This benefit first became available in 2008.

You will not be able to use this calculator to perform 2023 portability estimates until AFTER the proposed 2022 just values are set on June 1 2022. Next September 2017 Real Estate Market Activity. For more questions about Property Tax Portability in Florida see the Florida Dept.

An example of the 2 year window is if you are applying for homestead for 2020 you must have had homestead and a portability amount on your former property in 2019 or 2018 in order to transfer any portability benefit. The State of Florida has a few property tax exemptions including a homestead exemption. This creates a gap between the Market Value what the county values the property at and the Assessed Value the amount that taxes are paid on.

Property taxes for residents of Boca Raton amount to 465076396 on average each year. If you moved to Hillsborough County from another Florida County provide the most complete address you can and be sure to include the name of the County. To transfer the SOH benefit you must establish a homestead exemption for the new home within three.

Previous Property selling or sold. What Are Real Estate Taxes In Boca Raton Florida. Florida property owners can receive a 25000 property tax exemption for their primary residence.

Once you have completed part 1 2 print the form sign it Part 3 and return it to. Hillsborough County Property Appraiser. When buying real estate property do not assume property taxes will remain the same.

Of Revenues page on Homestead and Other Exemptions. 2 To encourage the sale of residences for those who might otherwise find the realty taxes too high to acquire other residences. On the Real Estate Tax Bill or use the parcel record search.

In Florida the first year a home receives a homestead exemption the property appraiser assesses it at just valueNow with that in mind for each of the following years the Save Our Homes Amendment SOH of the FL Constitution prevents the assessed value of said homestead property from increasing more than 3 per year or exceeding the percent change. Florida Homestead Real Estate Tax Portability Explained February 4 2022 by admin For those who have made a home in Florida and are considering a move to a new Florida home one of the most important things to be aware of is the newly enacted Property Tax Portability Amendment which impacts Homestead property. In 2008 Florida changed its law to allow homestead portability.

The law allows up to 2 years for transfer of the portability benefit. An additional 25000 homestead exemption is applied to homesteads that have an assessed value of more than 50000. Home prices in Florida have historically increased more than 3 annually.

The Big Three Grandfathered Homesteads Portability Westchase Fl Patch

Understanding Florida S Homestead Exemption Laws Florida Realtors

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

Florida Homestead Check For Homeowners

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

Homestead Portability What Is It And Should I Apply For It Us Patriot Title

Property Tax Portability Jennifer Sego Llc

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

Florida Homestead Check Home Facebook

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Save Our Homes And Homestead Portability John Parce Real Estate Key West

Florida Homestead Check Home Facebook

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

Federal Estate Tax Portability The Pollock Firm Llc

/arc-anglerfish-arc2-prod-tbt.s3.amazonaws.com/public/R76EFPWHBMI6TBKNIBWI6S7HAY.jpg)

Portability Benefit Can Reduce Tax Burden For Property Owners Moving Into Larger Or Smaller Homes